Direct selling is an industry with vast opportunities for aspiring entrepreneurs. The industry is constantly growing with annual sales of INR 23,800 Crore (USD 3.19 Billion) in 2020-21. According to the WFDSA Report, the number of active direct sellers in the country was 74.3 Lakhs (7.4 Million) as of May 2020. It is not a surprise that the number of people taking up direct selling as a profession is on the rise!

QNET is Asia’s leading direct selling company that empowers individuals by providing self-employment opportunities. Direct sellers can sign up for the opportunity from the QNET India website. QNET follows a well-established registration process to ensure that aspiring individuals have a seamless experience. The process includes a guided KYC process to verify a distributor’s details.

Technology plays a huge part in our lives. One might need precise information on how to complete their QNET KYC and if there are any prerequisites. This article is for all the folks who’ve recently signed up for the QNET direct selling opportunity. We have compiled a detailed list of all the necessary steps for completing the QNET KYC!

What is the QNET KYC?

KYC stands for Know Your Customer. It is an important process that helps QNET authenticate a direct seller’s identity. The KYC process is crucial because it also helps in minimising the risk of fraud. Furthermore, it improves the online identity of a direct seller and the account security.

QNET further deploys a Standard Operating Procedure (SOP) for ensuring that all its distributors and aspiring individuals are protected. The company also ensures that they are given the right information before proceeding with their KYC and registration. Let’s understand QNET’s Standard Operating Procedure before diving into the KYC process.

QNET’s Standard Operating Procedure to protect its distributors

QNET ensures that individuals are not misled during the registration and KYC process. It follows a Standard Operating Procedure (SOP) to ensure that distributors are integrated seamlessly into the business plan.

• After providing the demographic details, the individual will receive a call from the company’s customer support team (GSC) with a checklist. They will ensure that the individual is aware of the terms and conditions of the QNET business opportunity. In turn, this will confirm if the individual is indeed interested and provides his consent to sign up for the professional marketing opportunity.

• The next step involves a KYC check to verify the individual’s identity through their PAN card or Aadhaar card. (We will explain this below)

• Applicant must then submit a cancelled cheque to verify their bank account.

• One Time Password (OTP) will be sent to the individual’s registered mobile number to authenticate and verify the registration process.

• The individual’s registration is complete.

However, KYC is an elaborate process and an individual might require certain information before proceeding. Here is the step-by-step procedure to complete the manual KYC. An individual must be ready with important documents to complete the process. The individual must additionally download a few forms from the QNET website and fill them with accurate information.

Now that we have a brief idea about the prerequisites of the QNET KYC, let’s delve deep into the specifics of the process –

QNET KYC: Manually Uploading Documents

The Manual KYC process requires an individual to submit manual documents through the QNET Virtual Office.

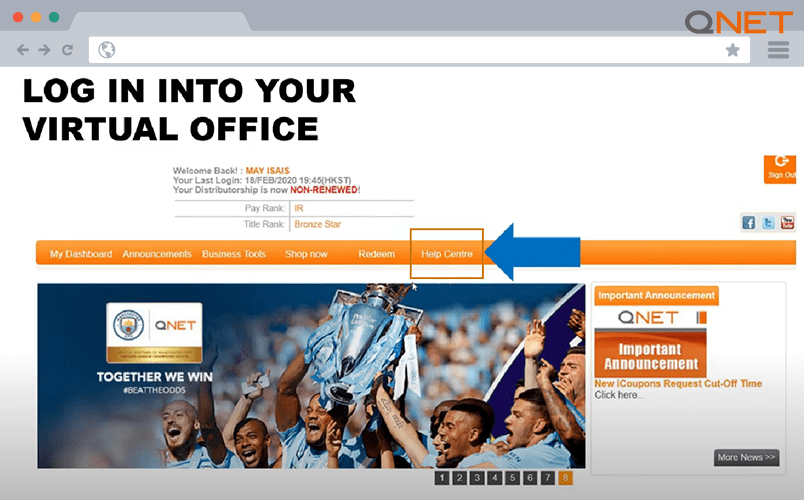

Step. 1 – Log in tothe QNET Virtual office. An individual can do this either through a website or on their smartphones. They simply enter their login credentials and proceed to the QNET Virtual Office dashboard.

It is also important to note that QNET will provide highly confidential details to the applicant. These credentials are specifically meant for the applicant and are not to be shared with anybody.

Step 2. – The next step is to click on the “Help Center”

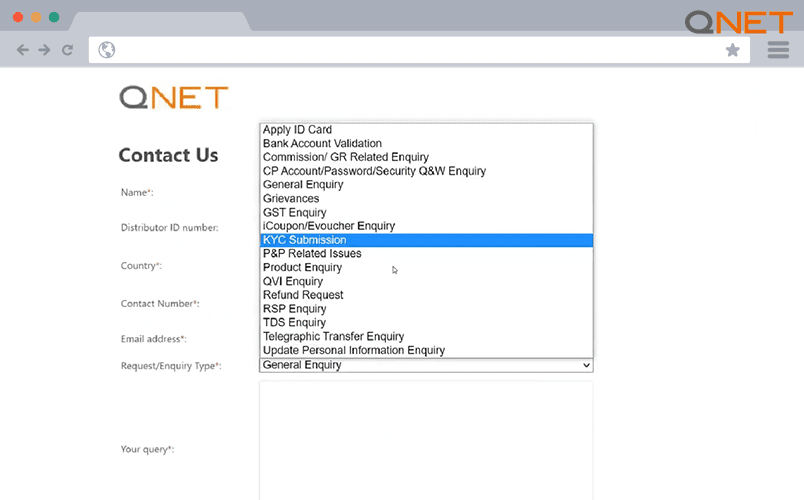

Step 3. – The applicant must fill in their details in the Contact Form. The details must be accurate and the applicant must not furnish any improper details.

Step 4. – Under the “Request/Enquiry Type”, choose the KYC Submission.

Step 5. – The next step requires the applicant to upload all necessary documents.

The documents that an individual must have before proceeding with their KYC include –

1) Pan Card Copy

2) Address Proof

3) Distributor Application form along with the signature. The distributor can download the form from the “My Transactions” section in the QNET Virtual Office.

4) Acknowledgement letter regarding the distributor presentations in the virtual office. The form is available under the “My Profile” section in the QNET VO.

Distributors must note that the documents must be clearly legible before uploading them. If the documents aren’t clear, then there is a possibility that their KYC will be incomplete. In certain cases, they may have to start over with the process. If there are queries even after rectifying the legibility, then the distributor must contact the QNET Help Center to fix the issue.

Step 6. – The final step is to submit the documents and wait for the verification results.

QNET KYC is a crucial process for an individual to become a verified QNET distributor. We’ve learnt the two methods that an individual could use for completing the process. If there are any more questions about the QNET KYC, individuals can send their queries to the QNET India Customer Support by writing an email or through a phone call –

QNET Support Centre Email Address: [email protected]

QNET India Support Centre Phone: +91 888 063 2532

For more information regarding the QNET India entrepreneurial opportunity, registration or products, visit the QNET India Website!